Even though it’s not easy for everyone to buy a home, it is in fact easier than ever to get a home these days with most lending agencies and banks being more liberal than ever with providing home loans and mortgages. Even if you don’t have a lot of capital or a lot of money to put down, you can still get the home of your dreams at a very affordable price.

A lot of us think that buying a home is a tough process, needing a large down payment, although this isn’t always the case. Buying a home largely depends on your budget. If you put a down payment on your home purchase, it will go towards your overall purchase. The more money you put down on a home when you purchase, the lower your monthly payments will be.

Those of us who don’t own a home live in rental houses and apartments. This can be a worthwhile solution, although your still paying money towards your housing that you could instead be putting towards a home of your own. Owning a home is a dream for many of us, especially when it comes to that dream home that we all hope to own one day. Apartments and homes are great to rent – although most these days will cost you just as much as a mortgage payment – which doesn’t make any sense at all.

Instead, you can easily convert your rental payments into monthly instalments towards your own home. All across Australia, you can find of lot of banks and lenders that offer easy to get loans for purchasing your own home or real estate property at low interest rates. With a lot interest rate, you can get the home of your dreams and enjoy low monthly payments.

Keep in mind, you need to choose a loan plan that’s best for you. You can go through bank, through a lender, or use a service online. There are many different ways that you can go, although real estate agents seem to be the most common now days. Good real estate agents will be more than willing to help you get a great deal on the home, at prices that are right for you. Anytime you buy a house, you should always plan ahead, get yourself a real estate agent, and then pursue your dream home.

If you plan your budget and take things one step at a time, you’ll be closer than you think to the home of your dreams. If you choose to keep renting and pay money toward something you don’t own – the home of your dreams will continue to slip away. Take action now and stop renting – find the home of your dreams and put your money towards owning it instead.

“There has been a bit of an adjustment and there’s some great opportunities out there for the astute purchaser,” Ray White Double Bay principal Elliott Placks said.

The number of new listings for his agency are up 15 per cent compared with the start of last year.

Expats are already pouncing — they have the bonus of a weak Australian dollar. “Expats have hit the go button,” says Hunter Manor buyer’s agent Peter Jinks.

He found last week’s buyer of a four-bed designer home with ocean views at 21 Yanko Ave, Bronte, that sold for $5.5 million to an expat returning from New York.

With the Aussie dollar presently buying 71 cents USD, it cost him $3.9 million. The sale was via Phillips Pantzer Donnelley’s Alexander Phillips, who also sold 23 Yanko last week for about $11.5 million.

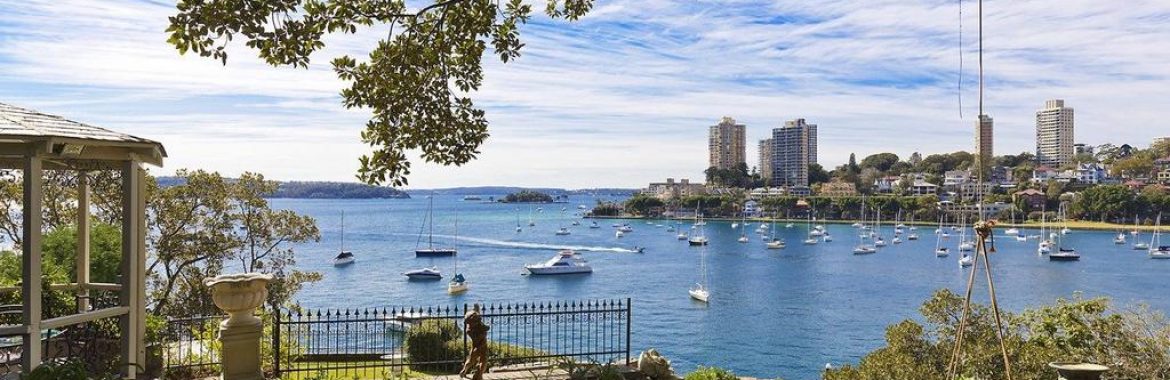

Among Mr Placks’s listings are the historic Elizabeth Bay waterfront Tresco, in the name of Janette Waterhouse who is the wife of the stockmarket trader David Waterhouse.

On a massive 3300 sqm block at 97 Elizabeth Bay Rd in the exclusive Elizabeth Bay Loop, there’d been hopes of $50 million through other agencies. The new guide for the seven bedroom home is $45 million.

Mr Placks also has a revised price guide for the Bellevue Hill home of fund manager Ari Drogaand his architect wife, Lisa.

Last October, the palatial six-bedroom Allala, which is set across 974sqm with an extra 229sqm of private adjoining garden land, had hopes of $14 million.

It now has a price guide of 11 million ahead of its March 6 auction, in conjunction with Sotheby’s.

There’s already been an offer just under that figure. The Drogas are keen to sell having bought Bonnington, an historical F. Glynn Gilling-designed house, around the corner for $20.4 million through Mr Placks and co-agent Ashley Bierman.

Listings are also up on last January at Richardson and Wrench Double Bay.

“We have 15 properties going to auction in February compared with 10 last year — that equates to a 50 per cent increase,” principalMichael Dunn said.

James Dunn has a split-level whole-floor Darling Point penthouse at 11/4 Marathon Rd set for February 27 auction with a guide of $5.3 million.

The four-bedroom 11th floor apartment in the tightly held ‘Wiston’ building with harbour views is attracting interest from both downsizes and young executive couples. There are two bathrooms and a double garage.

It’s owned by the Koo family who are looking to downsize due to spending much of the year overseas these days.

If you are taking the next step in life and purchasing a home, chances are that you are feeling the pressure and the anxiety that goes along with this difficult decision. Those who buy homes are very anxious, eager to get any information they can about real estate. Before you buy a home, it always helps to learn all that you can.

The first thing you’ll need to do when buying a home is to find out just how much you can qualify for or afford to borrow. You should also make it a point to check your credit and know where you stand. If you have any problems, you should strive to correct them for you attempt to borrow money for a home. The higher credit rating you have, the lower your interest rates will be.

If you can, you should always attempt to get pre approved by a mortgage broker or lender, as this will show your commitment to the mortgage. Also make sure to look for any payment or prepayment options that can help you take a few years away from your mortgage. Once you have been pre approved for a mortgage and know where you stand with your monthly payments, you can start shopping for property.

When you shop for a home, you should only buy real estate that is perfect for you. Before you start looking, you should always make a list of everything you want your home to have, based on what you want and what you actually need. You should also make sure that you mark out any areas that you are willing to come to a compromise on, just in case you have to.

To assist you with finding the perfect home, you should enlist the services of a reputable real estate agent. When you meet with your agent, you will go over how much you are willing to spend, and what type of home you are looking for. You’re agent will know where ideal properties are, and help you find the home that is best for you.

Your agent will supply you with a list of potential properties that meet your budget and your features. Once you get the list, you should drive by the homes and check out both the home and the neighbourhood. You should consider the appearance and location of the home, safety, access to the freeway, schools nearby, commute time to work, local shopping, and even recreational activities.

If you don’t find something that interests you the first time, you should keep looking until you find the home that is best for you. Your agent can help with tours of homes and such, even tell you information about neighbourhoods that you aren’t familiar with. If you have chosen a good real estate agent, he will care about helping you find a home and go out of his way to ensure that you get exactly what you want.

To get the most from buying a home, you should always hire a real estate agent that you can trust. Your agent will go a long way in helping you buy a home, from finding properties to giving you pointers and tips along the way. Good real estate agents will care about your satisfaction, and will do all that they can to help you find the home of your dreams. You can always buy a home without a real estate agent, although it will take you longer and you won’t get the help and other amenities that a real estate agent will bring to the table.

According to AMP Capital Chief Economist Shane Oliver, the housing downturn – both in terms of slowing construction and falling house prices – will detract from economic growth to the extent that an interest rate cut will be needed to protect the RBA’s inflation target.

He argues this is because house price falls lead to what is known as the “negative wealth effect”.

Applied to the property market, the theory states that people spend less when house prices fall, as they perceive that their wealth has declined.

“That’s the main threat,” Oliver tells realestate.com.au. “And that leads to weaker consumer spending, which has the impact of keeping price inflation lower for longer. [Conversely], when property prices were rising in the past, people were happy to spend more and save less, despite lower wages.”

Morgan Stanley also predicts a rate cut. The investment bank argued in a recent report that house prices would likely drop by twice as much as initially forecast, to 15-20% below peak values, and that the RBA would therefore be under pressure to raise rates, to reverse declining consumer spending.

However, realestate.com.au’s Chief Economist Nerida Conisbee believes that while a weaker than expected economic performance in the third quarter of 2018 led the inflation rate to drop to 1.9%, there wasn’t enough data to support cutting the official cash rate.

“The inflation rate’s fall below 2% is one of the reasons some commentators have speculated that the RBA may soon cut the interest rate. But [when the inflation rate drops below 2%], it isn’t an automatic response from the RBA to cut the rate; they also look at the outlook as to where inflation will head without their intervention,” says Conisbee.

“Although we had a weaker than expected GDP result in the September quarter and consumer sentiment is low, unemployment is also low. The data out there is too mixed to make a move on rates.”

Persistent increases in short-term money market interest rates might, however, also influence the RBA’s decision.The big four banks source roughly 20% of their money from short-term money markets, and the overseas funds have become increasingly expensive to access, cutting into the banks’ home loan profit margins.

Higher mortgage rates, however, would have a negative impact on consumer spending, as well as the RBA’s inflation target and the country’s economic performance more broadly.

According to Oliver, it’s another reason why the RBA might cut the official cash rate.

“The Reserve Bank might say, ‘well, we don’t want mortgage rates to go up, because that will affect the economy, therefore we will cut the cash rate with the aim of bringing down the debit rate and offsetting the increase in funding cost that the banks have experienced,” he says.

If you’re ready to buy a new house, you’re going to need a Home Purchase lender. And finding one online is convenient and simple! However, there are a few things you should look out for to ensure that your lender has your interests–and not his–as his top priority.

Make sure your lender offers options

There are a lot of options other than the traditional 30-year fixed rate mortgage. Depending on your needs and personal situation, an Adjustable Rate Mortgage (ARM) or Interest-Only mortgage might be a better fit for you. Or, possibly, you may prefer a loan with a longer or shorter term. A good lender should be able to offer you a variety of options so you can find the one that best suits your needs. Be wary of any lender that tries to push one particular type of loan.

Get your “pre-approval” in writing

Some Home Purchase lenders will “pre-qualify” you–but that doesn’t mean you’re guaranteed to get the loan! In fact, in most cases, “pre-qualification” means almost nothing at all. Choose a lender who will “pre-approve” your application instead, which is a more involved process. When you’ve been “pre-approved,” the loan officer has contacted your employer, bank, credit card companies, etc. Once you’re “pre-approved,” you’re a lot more likely to get the final approval on your loan.

“Lock in” the rate you’re quoted

Interest rates change almost daily–they can be down on Monday, and sky-high by Friday! And some lenders will quote you a super low rate to get your business, even though they know the rate may change by the time your loan is finalized. If a lender quotes you an interest rate, ask him/her to “lock it in” for 30, 60 or 90 days. Reputable online Home Purchase lenders will guarantee you your promised rate even if it takes another month or two until you close the loan.

Once you know your online Home Purchase lender is willing to offer you options, pre-approve your loan, and lock-in your rate, it’s time to compare rates, fees and other charges to make sure you’re getting the best deal.

PROFESSIONAL PERTH’S MORTGAGE BROKER

PROPERTY MANAGEMENT AGENTS IN KENWICK

PREMIER PERTH’S CLEANING COMPANY